Calculate book value of equipment

To calculate depreciation subtract the assets salvage value from its cost to determine the amount that can be depreciated. Remaining lifespan SYD x asset cost salvage value How it works.

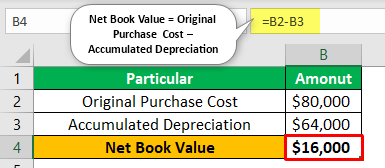

Net Book Value Meaning Formula Calculate Net Book Value

Like a lot of accountings accepted principles the rules on leases have changed over time.

. For example if the present value of all lease payments for a production machine is 100000 record it as a debit of 100000 to the production equipment account and a credit of 100000 to the capital lease liability account. An adjusted book value is a measure of a companys valuation after liabilities including off-balance sheet liabilities and assets are adjusted to reflect true fair market. The annual depreciation on an equipment with a useful life of 20 years a salvage value of 2000 and a cost of 100000 is 4900 100000.

Book value is the amount found by totaling a companys tangible assets such as stocks bonds inventory manufacturing equipment real estate and so forth and subtracting. For example a company has a widget making machine on its books at 500000. If Im in a hurry thats why I like to check online with Nada guides where you can easily look up the blue book value info if its a camper less than 20 years old.

If the company aggregates its assets you may have to look at the companys notes to the financial statements. The value of the land itself and the value of whatever is built on the land ie its improvements To find the total value of your property youll need to add these two values together. Get 247 customer support help when you place a homework help service order with us.

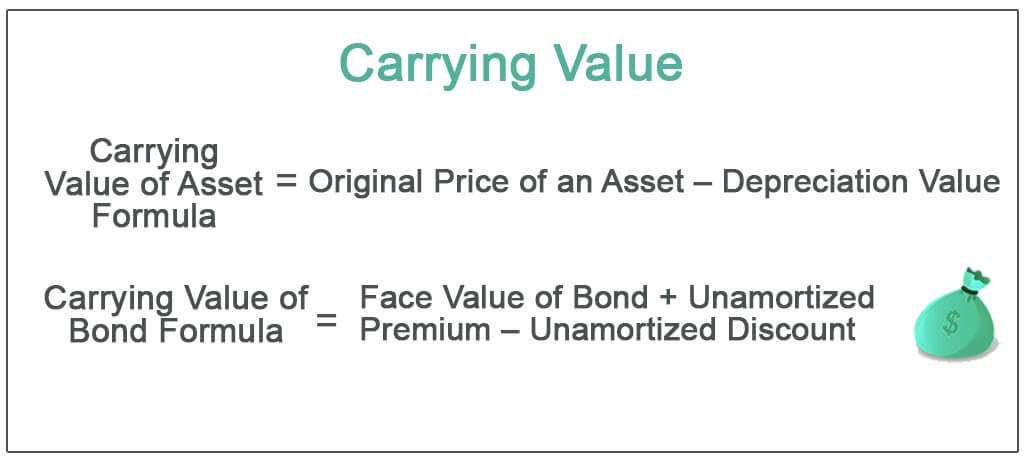

The book value is the amount the equipment is currently worth. The resulting net book value of the asset total price paid minus any cumulative depreciation. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

In effect it is a renewed rallying call to devote more thought to ones career than the blind obeisance to college and office work. The carrying value or book value is an asset value based on the companys balance sheet which takes the cost of the asset and subtracts its depreciation over timeThe fair value of an asset is. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Depreciation 800 3 26667. An Inquiry into Values - namely of the value of craft type work and the intelligence required to go into it. Note that the book value of the asset can never dip below the salvage value even if the calculated expense that year is large enough to put it below this value.

21st Century Business - Third Edition A new baby A Surprise for Feena A Trip in Time - Core Reader 4 A Way with Words Book 1 A Way with Words Book 2 A Way with Words Book 3 A Way with Words Book 4 A Way with Words Book 5 A Way with Words Book 6 A Way with Words Junior Infants A Way with Words Senior Infants Active Science Active Science - 2nd Edition. Free car value appraisal calculator. Estimate the assets lifespan which is how long you think the asset will be useful for.

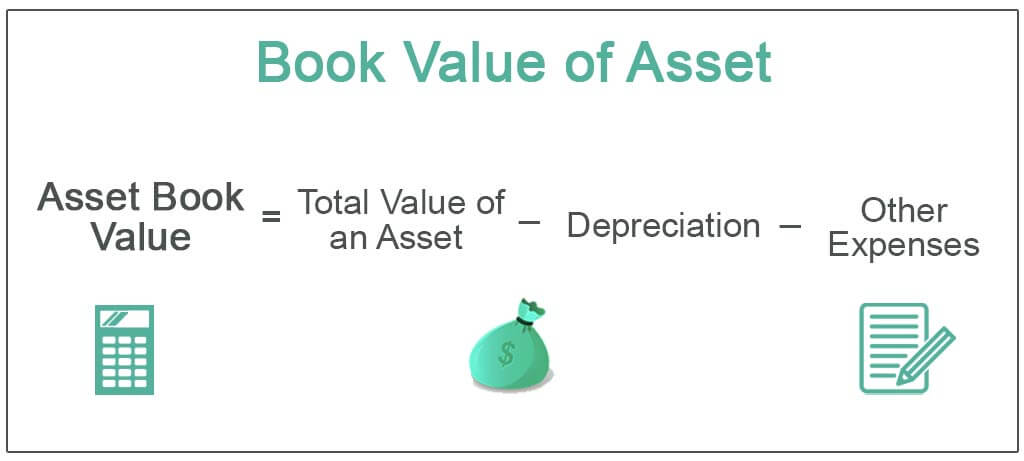

For assets the value is based on the original cost of the asset less any depreciation amortization or impairment costs made against the asset. How to Calculate Depreciation Using the Straight Line Method. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Divide this amount by the number of years in the assets useful lifespan. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

To arrive at the book value simply subtract the depreciation to date from the cost. Find the amount of Depreciation per Year by calculating depreciable costassets lifespan. To calculate SYD depreciation you add up the digits in the assets useful life to come up with a fraction that will apply to each year of depreciation.

Whether youre trading your vehicle in at a dealer or planning to sell it Edmunds makes it. So if youre looking for the Kelly Blue Book Value right now youll probably need to call your local library credit union or camper dealer to look at their Kelly Blue Book. Cost Scrap Value Useful Life 5050 505.

Find the book value of the equipment on the companys balance sheet. He plans to sell the scrap at the end of its useful life of 5 years for 50. Value of the asset 1000 200 800.

Use our online tool in order to calculate the trade-in value for your car or SUV and find your new or certified pre-owned Land Rover SUV today. The formula to calculate annual depreciation through straight-line method is. Estimate the salvage value or how much the asset will be worth when its no longer useful.

Ali bought a printer for his office at a cost of 5050. Adjusted Book Value. If the computer has a residual value in 3 years of 200 then depreciation would be calculated on the amount of value the laptop is expected to lose.

NW IR-6526 Washington DC 20224. Calculate the annual depreciation Ali should book for 5 years. Some vehicles are shown with optional equipment and retailer-fit accessories that may not be available in all markets.

In the example above the assets book value after 6 years would be 10000 - 6000 or 4000. Section 179 deduction dollar limits. We welcome your comments about this publication and your suggestions for future editions.

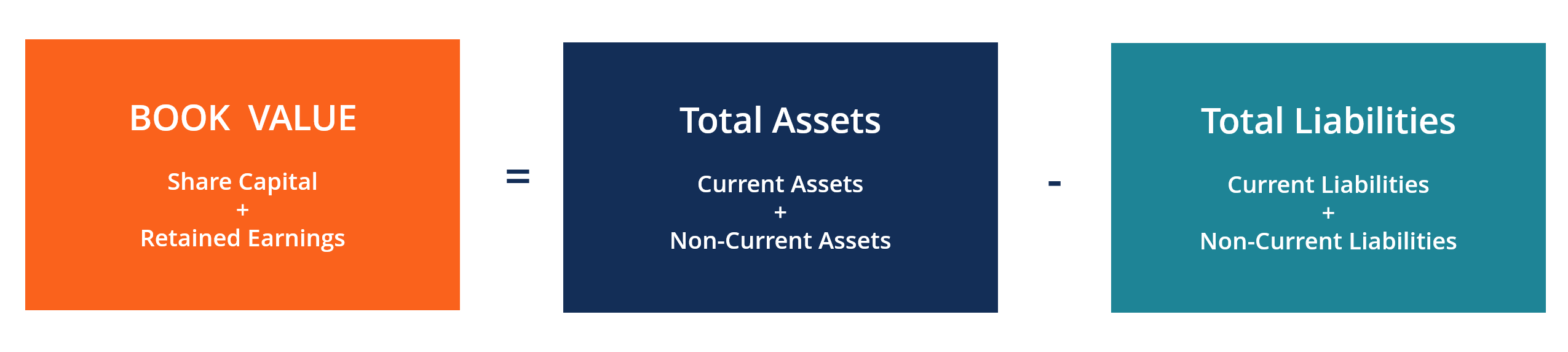

Book value cost value annual depreciation x age For example if your item cost you 20000 five years ago and you depreciate 2000 for it every year its book value would be 10000 meaning that in your financial books the item is worth 10000 after five years of use. The value of a piece of land is usually determined by two things. What Is Book Value.

Get 247 customer support help when you place a homework help service order with us. In accounting book value is the value of an asset according to its balance sheet account balance. More Book Value Defined.

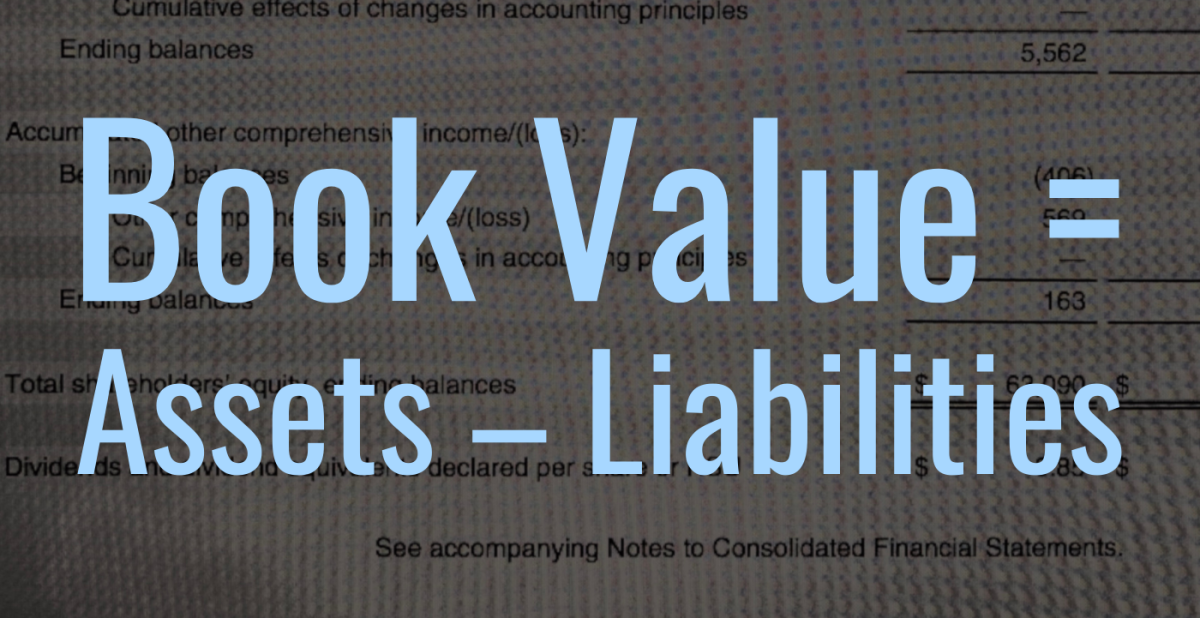

Traditionally a companys book value is its total assets clarification needed minus intangible assets and liabilities. For example the. When you buy the item its book value is its cost value.

Add the value of the land and improvements to get the total value. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Get instant used car value and trade-in value online with Edmunds.

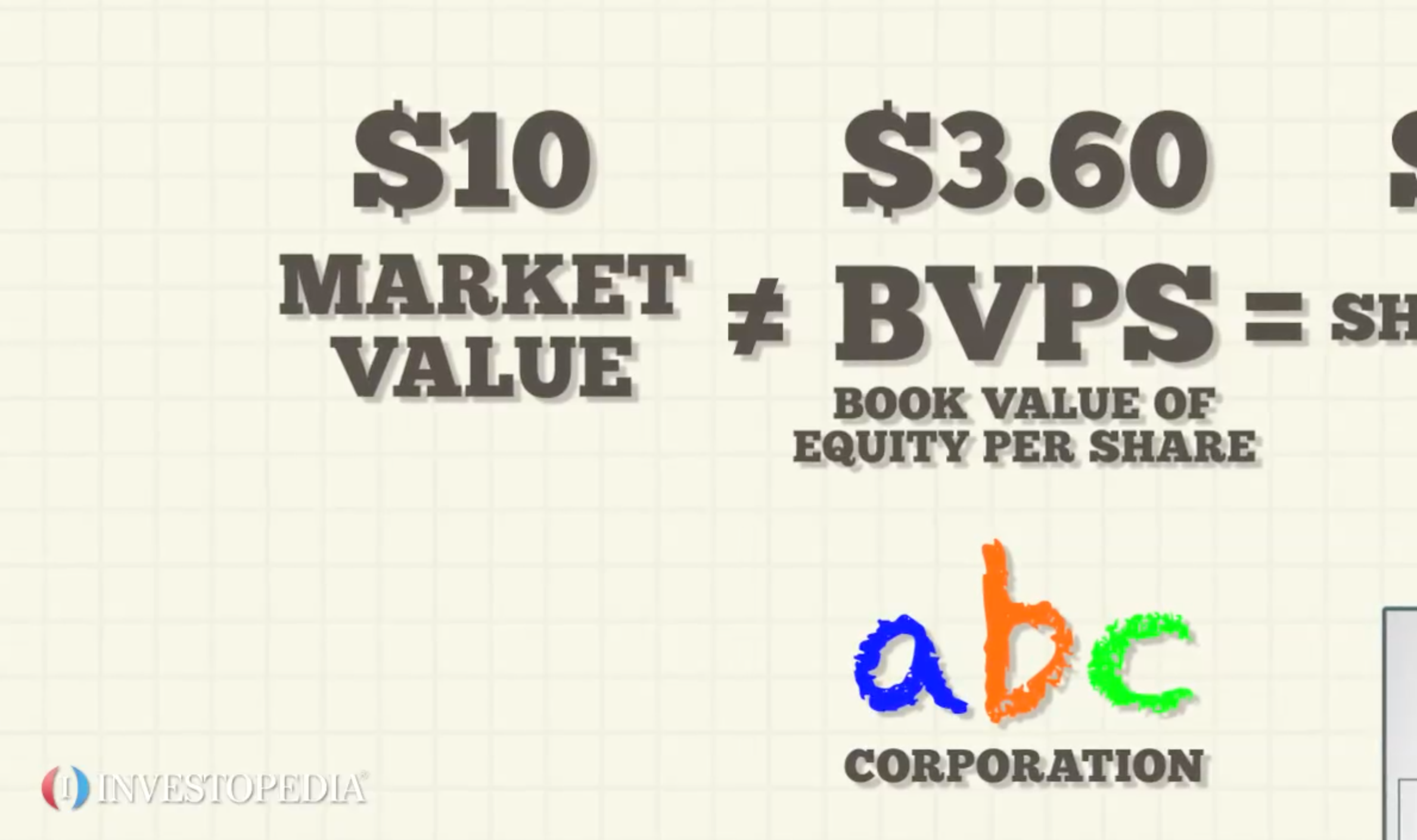

The book-to-market ratio is used to find the value of a company by comparing its book value to its market value with a high ratio indicating a potential value stock. Purchase price - salvage value. Crawfords book brings across a similar message to Pirsigs Zen And The Art Of Motorcycle Maintenance.

Book Value Formula How To Calculate Book Value Of A Company

Net Book Value Meaning Formula Calculate Net Book Value

/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

Book Value Vs Market Value What S The Difference

Book Vs Market Value Key Differences Formula

Book Value Of Assets Definition Formula Calculation With Examples

Book Value Per Share Bvps Ratio Formula And Excel Calculator

What Is Book Value Definition How To Calculate Faq Thestreet

What S The Difference Between Book Value Vs Market Value

Book Value Of Equity Formula And Calculator Excel Template

.jpg)

Net Book Value Nbv Definition Meaning Investinganswers

Book Value Definition Importance And The Issue Of Intangibles

Carrying Value Definition Formula How To Calculate Carrying Value

Straight Line Depreciation Accountingcoach

Book Value Per Share Bvps Ratio Formula And Excel Calculator

Book Value Of Equity Formula And Calculator Excel Template

Book Value Vs Market Value How They Differ How They Help Investors

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping